EMI Calculator: Your Ultimate Tool for Smart Loan Planning

In today's financial landscape, loans have become an integral part of achieving personal and professional goals. Whether it's buying a home, purchasing a car, or funding education, understanding your loan's Equated Monthly Instalment (EMI) is crucial. An EMI calculator simplifies this process, offering clarity and aiding in informed decision-making.

What is an EMI?

EMI, or Equated Monthly Instalment, is the fixed payment amount made by a borrower to a lender at a specified date each calendar month. It comprises both the principal and the interest components, ensuring the loan is repaid over a predetermined tenure.

How Does an EMI Calculator Work?

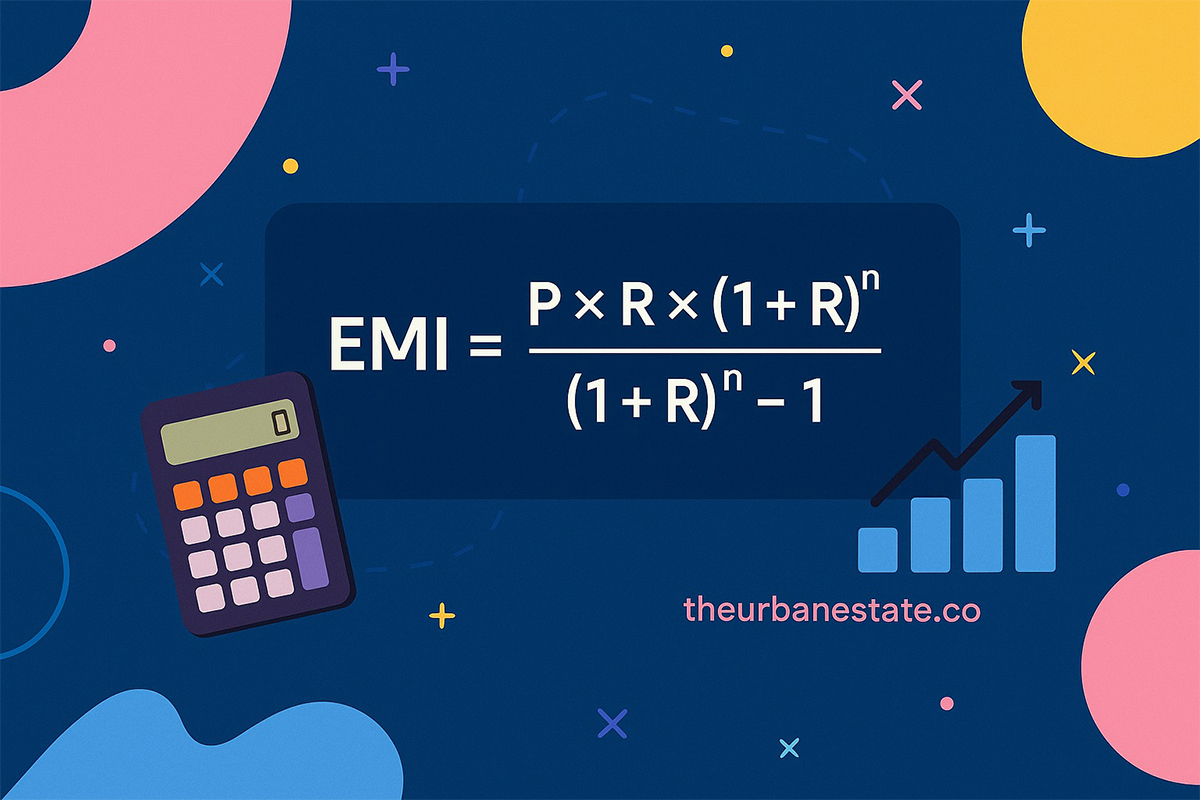

An EMI calculator uses the following formula:

[P x R x (1+R)N]

EMI = --------------------

[(1+R)N - 1]

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual interest rate divided by 12)

- N = Loan tenure in months

By inputting these variables, the calculator provides:

- Monthly EMI amount

- Total interest payable

- Total payment (principal + interest)

This tool eliminates manual calculations, reducing errors and saving time.

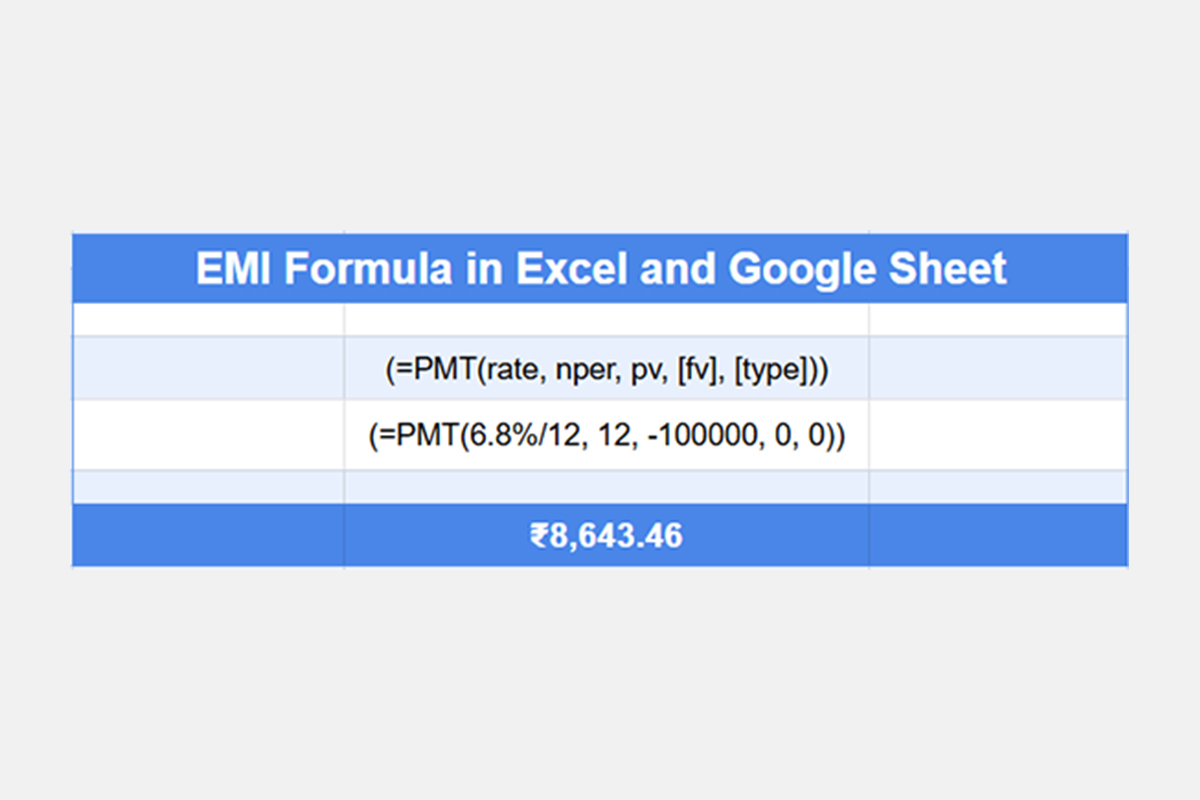

EMI Formula in Excel and Google Sheet

Understanding your Equated Monthly Instalment (EMI) is essential when planning a loan. EMI represents the fixed amount you pay every month towards loan repayment. Using Excel, you can easily calculate your EMI using either the PMT function or the manual mathematical formula. In this guide, we'll explain both methods to calculate EMI using our formula in sheet to simplify the process.

Method 1: Using the PMT Function in Excel (Recommended)

Excel's PMT function is the simplest and most efficient way to calculate EMI. It handles the math for you based on a fixed interest rate and loan tenure.

PMT Formula Syntax:

=PMT(rate, nper, pv, [fv], [type])Explanation of Parameters:

- rate: Interest rate per period. For monthly EMI, divide the annual rate by 12 and then by 100.

- nper: Total number of payments (loan tenure in months).

- pv: Present value or principal amount of the loan. This should be entered as a negative number to indicate a cash outflow.

- fv: (Optional) Future value or the balance you want after the last payment, usually 0.

- type: (Optional) 0 if payment is due at the end of the period (default), or 1 if due at the beginning.

Example Calculation:

Assume you take a loan of ₹1,00,000 at an annual interest rate of 6.8% for a period of 1 years (12 months).

The formula in Excel would be:

=PMT(6.8%/12, 12, -100000)

Result: ₹8,643 (approximately)

Method 2: Using the Manual EMI Formula

If you want to understand the math behind the EMI or calculate it without Excel functions, use the standard formula:

EMI = (P x r x (1 + r)^n) / ((1 + r)^n - 1)Where:

- P = Principal loan amount

- r = Monthly interest rate (Annual Rate ÷ 12 ÷ 100)

- n = Loan tenure in months

Example:

For a ₹1,00,000 loan at an annual interest rate of 6.8% and a 12-month tenure:

r = 6.8% / 12 / 100 = 0.005

n = 12

EMI = (100000 * 0.005 * (1 + 0.005)^12) / ((1 + 0.005)^12 - 1)

This again gives you an EMI of approximately ₹8,643.

Why Use Excel for EMI Calculation?

- Flexibility: Adjust interest rates and tenures quickly to compare EMI options

- Transparency: See the math behind the numbers using formulas

- Accuracy: Excel eliminates manual errors and miscalculations.

Types of EMI Calculators

Home Loan EMI Calculator: Ideal for prospective homeowners, this calculator helps determine monthly payments based on loan amount, interest rate, and tenure. It assists in budgeting and comparing different loan offers.

Car Loan EMI Calculator: Planning to buy a vehicle? This calculator estimates your monthly instalments, helping you choose a loan that aligns with your financial capacity.

Personal Loan EMI Calculator: For unsecured loans like personal loans, this tool aids in understanding repayment obligations, ensuring you borrow within your means.

Education Loan EMI Calculator: Students and parents can plan educational expenses by calculating EMIs, considering moratorium periods and varying interest rates.

Loan Against Property EMI Calculator: This calculator assists in evaluating EMIs when securing loans against owned property, ensuring manageable repayments.

Benefits of Using an EMI Calculator

- Financial Planning: Helps in budgeting monthly expenses by providing a clear picture of loan repayments.

- Loan Comparison: Enables comparison between different loan offers based on EMI, interest rates, and tenure.

- Time-Saving: Delivers instant results, eliminating the need for complex manual calculations.

- Accuracy: Reduces the risk of errors in computation, providing reliable data for decision-making.

- Flexibility: Allows users to adjust variables to see how changes affect EMIs, aiding in selecting the most suitable loan terms.

Factors Affecting EMI

- Loan Amount: Higher principal leads to higher EMIs.

- Interest Rate: Increased rates result in higher monthly payments.

- Loan Tenure: Longer tenures reduce EMI but increase total interest paid.

- Prepayments: Making lump-sum payments can reduce the principal, thereby lowering EMIs.

- Processing Fees: Additional charges can affect the overall loan cost and EMI.